Auto Insurance Rates Are Increasing – Here’s Why

Dion Cruz • November 1, 2024

If you’ve been surprised by the rising cost of your auto insurance, you’re not alone. Auto insurance rates continue to climb, and several factors are contributing to this trend. Here’s what’s driving up premiums and what you can do to manage your costs.

1. Rising Vehicle Theft

One of the most significant contributors to rising auto insurance premiums is the increase in vehicle theft. According to the National Insurance Crime Bureau, vehicle theft rates have been on a steady climb since 2019, hitting an all-time high in 2023. This surge in thefts not only affects the individuals whose vehicles are stolen but also contributes to higher insurance costs across the board, as insurers adjust premiums to cover the increasing number of claims.

2. More Expensive Repairs Due to Advanced Technology

Modern vehicles are equipped with advanced technology, including driver assistance systems and complex sensors. While these features improve safety, they also make cars much more expensive to repair. In fact, fixing these advanced systems can add up to 37.6% more to repair costs compared to traditional vehicles. As a result, insurers have to factor these higher repair costs into their pricing models, which leads to higher premiums for consumers.

3. Increasing Severity of Accidents

Accidents are becoming more severe, and that’s another factor driving up auto insurance costs. With larger and heavier vehicles, such as SUVs and electric cars, the impact of collisions can be much greater, leading to more significant damage and higher medical and repair costs. Additionally, the growing number of electric vehicles on the road poses new challenges, as many safety systems and guardrails are not yet equipped to handle these heavier vehicles, increasing the severity of accidents.

4. Used Vehicle Prices are Skyrocketing

The price of used cars has surged by nearly 47.9% as of Q3 2023. This means that when an insurance company has to replace a totaled vehicle, the cost to do so is much higher than in previous years. The sharp rise in used car prices is directly impacting insurance premiums, as insurers adjust to cover the higher replacement costs.

What Can You Do About Rising Auto Insurance Rates?

While rising premiums can be frustrating, there are a few strategies you can use to manage your costs:

- Review Your Coverage: Take the time to review your auto insurance policy. You may be able to adjust your coverage to better fit your current needs, potentially lowering your premium.

- Consider a Higher Deductible: Increasing your deductible can lower your monthly premium, but be sure you’re comfortable with the out-of-pocket cost if you need to file a claim.

- Bundle Your Policies: Many insurers offer discounts if you bundle your auto insurance with other types of coverage, such as home or renter’s insurance. This can be a great way to save money.

If you’re concerned about your rising auto insurance premiums and want to explore your options, Schedule a Consultation

with us today. We’ll help you navigate the changes and find a solution that works for your budget and coverage needs.

If you've noticed your home insurance premiums increasing, you're not alone. In today’s market, several factors are contributing to rising insurance costs, and homeowners are feeling the impact. The reasons behind these increases go beyond just inflation—they stem from a combination of economic, environmental, and industry-specific trends that are driving up the cost of repair, rebuild, and coverage. Here's a look at what’s causing home insurance rates to climb and what you can do about it. What’s Driving Up Home Insurance Rates? Labor Shortages and Material Costs: The cost of building materials has surged dramatically since 2020, and labor shortages in the construction industry continue to push costs even higher. From July 2023 to July 2024, residential reconstruction costs alone rose by 4.9%. This means that if your home needs repairs, those costs will likely be higher than just a few years ago. Insurers adjust their premiums to account for these increased expenses, so you're paying more to reflect the true cost of rebuilding. Extreme Weather Events: Catastrophic weather is becoming more frequent and severe. In 2023 alone, the U.S. experienced 28 separate billion-dollar weather-related disasters. These events result in significant damage to homes across the country, driving up insurance claims. When insurance companies face higher claim payouts, they adjust their rates to offset these costs, meaning higher premiums for everyone. Water and Fire Damage: According to recent reports, over 380,000 residential fires in 2022 led to nearly $11 billion in property damage. Meanwhile, water damage, including damage from freezing, has become one of the most common home insurance claims. With one in 60 homes experiencing water-related property damage each year, it's clear why insurers are increasing premiums to cover these growing risks. What Can Homeowners Do? Though rising insurance rates are out of your control, there are a few steps you can take to better manage your premiums: Schedule a Coverage Review: This helps ensure you’re not over- or under-insured. Your insurer can review your coverage and help tailor your protection to meet current market conditions. Consider a Higher Deductible: If you're comfortable with a higher out-of-pocket cost in the event of a claim, increasing your deductible may lower your premium. Look for Discounts: Installing safety features like fire alarms, water sensors, or even smart home technology can sometimes lead to discounts on your insurance. Ask your insurer about potential savings. Bundle Your Policies: Bundling your home and auto insurance, when available, can help you save on both policies. Stay Ahead of Rising Costs As home insurance rates continue to increase, it’s essential to stay informed and proactive. For tailored advice and solutions that fit your needs, schedule a consultation with us today. We'll help you navigate these changes and find the best options to protect your home without overpaying. Understanding why premiums are rising is the first step to making informed decisions about your home insurance. Let's work together to ensure you have the right coverage at a fair price.

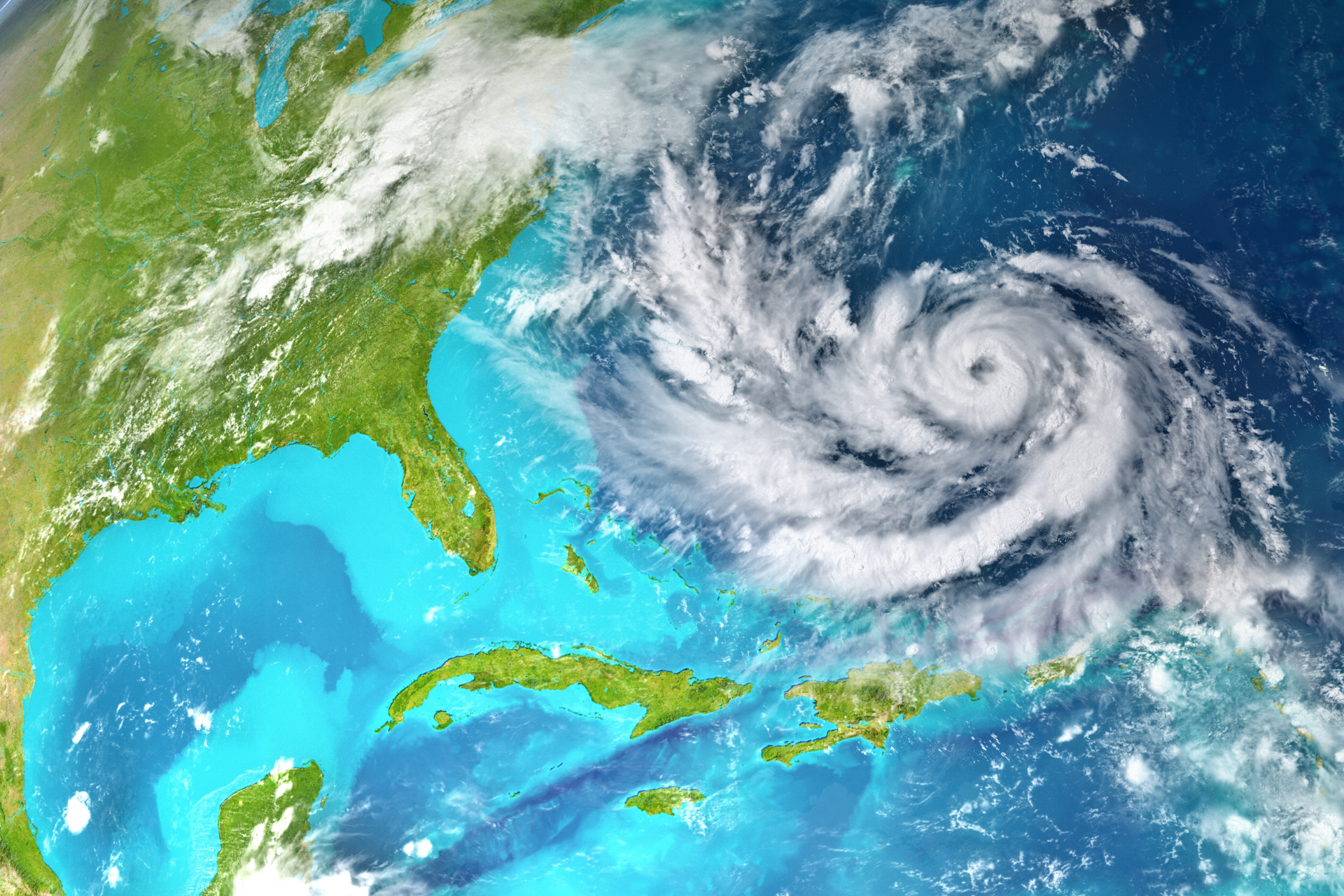

Hurricane season officially kicks off on June 1st, and with it comes the need for heightened awareness and preparation. At IMG, we emphasize the importance of being prepared for any storm, and we've compiled a list of essential tips to help you stay safe and minimize damage to your home. Here are some key steps to take: 1. Determine Your Risk Understanding the potential wind and water hazards in your area is the first step in hurricane preparedness. Hurricanes can impact areas hundreds of miles inland, so it's crucial to know your home's risk level. Check Historical Data: Look up historical hurricane tracks by zip code. Determine Floodplain Zone: Find out if your home is in a floodplain zone to better understand your vulnerability. 2. Create or Review Your Evacuation Plan Having a well-thought-out evacuation plan is essential. Ensure everyone in your household is familiar with it. Communication Plan: Set up group text messaging threads for easy and efficient communication once a storm is forecasted. Familiarize Everyone: Make sure every member of your household knows the plan and their role in it. 3. Prepare a GO Bag A GO bag is crucial in case of an evacuation request. Here are some items to include: Personal Identification: Birth certificates, social security information, marriage licenses, and passports in a waterproof container. Medications: A list of current medications and a two-week supply of each. Essential Supplies: Non-perishable food, water, flashlights, batteries, first aid kit, and personal hygiene items. Clothing and Bedding: Extra clothing and bedding for all family members. Cash and Credit Cards: ATMs and banks might not be operational during or after a hurricane. 4. Secure Your Home and Yard Taking steps to secure your home can significantly reduce damage. Secure Windows and Doors: Install storm shutters or board up windows and doors. Outdoor Items: Bring in outdoor furniture, grills, and other items that could become projectiles in strong winds. Vehicle Safety: Move cars into the garage or another secure location. Pet Safety: Ensure family pets have a safe place to shelter. 5. Organize Medications and Essential Documents Medications: Keep an updated list of current medications and ensure a two-week supply is ready. Essential Documents: Have birth certificates, social security information, marriage licenses, and passports ready in a waterproof container. 6. Be Ready to Evacuate and Be Ready to Stay In some situations, you may need to shelter in place. Evacuation: Have your GO bag ready and know your evacuation routes. Sheltering in Place: Ensure you have enough food, water, and supplies to last at least a week. 7. Follow and Like Our Social Media Accounts Stay informed with real-time updates and additional tips by following us on social media. Like and follow our pages for the latest information to keep you and your loved ones safe this hurricane season. Being prepared can make all the difference when it comes to staying safe during hurricane season. By following these tips, you'll be better equipped to handle whatever comes your way. Stay safe, and don't forget to follow us on social media for more updates and information.